Just a third generation small town guy with a rural area farm blogging about issues effecting Small Town USA and sharing the best small town business ideas to help preserve rural life and financial independence.

Thursday, August 30, 2012

Spanish Banks Borrow Record €402 Billion Euro

Spanish banks borrowed a record €402bn ($515bn USD) from the European Central Bank in July, leaving them as far as ever from returning to capital markets, and heaping further pressure on Madrid as it tries to avert a full sovereign bailout.

The banks borrowed 10% more than the €365bn they tapped in June, Tuesday's data from the Bank of Spain showed. Spiralling debt costs and balance sheets ravaged by a domestic property bubble that collapsed in 2008 have shut most domestic banks out of the bond markets.

The banks' use of the ECB facility has increased sharply this year, rising from €161bn in January, and the sector was propped up in July with the promise of a European rescue package – which it has yet to tap – worth up to €100bn.

The pattern is similar if less acute in Italy – like Spain at the sharp end of the eurozone debt crisis – where banks held €283bn in ECB funds in July compared with €281bn in June, Bank of Italy data showed last week.

In Spain, only heavyweights with big operations abroad such as Santander and BBVA continue to have few problems raising funding from the market.

One likely factor in the July increase was the higher charges that some clearing houses were levying on the use of Spanish bonds – which many domestic banks have invested heavily in – as collateral for raising funds, one analyst said.

LCH.Clearnet, one of Europe's largest clearing houses, raised the cost of using Spanish debt as collateral in July following a series of ratings downgrades on the country's debt to the lower end of the investment grade spectrum.

Many investors fear that cleaning up the banking system as well as Spain's public accounts while recession rages may prove too difficult for the government, and expect the country to seek a full-blown bailout on top of the banking aid.

tags:

bank bailout,

debt crisis,

European Central Bank,

eurozone,

Spain banks,

Spain banks borrow,

Spanish banks,

Spanish bonds

Location:

Spain

A Cow Manure Shortage Too?

It's very seldom someone talks about the quality and amount of cow dung, but in one southern Wisconsin city that's all they've been talking about lately.

The drought has caused a shortage of flattened, dried cow manure – or cow chips – for the Wisconsin State Cow Chip Throw and Festival, which attracts about 300 throwers and 40,000 spectators to Prairie du Sac, Wis.

"This is my 24th throw, and it's never been this difficult to find chips," said Marietta Reuter, who helps organize the festival that runs Friday and Saturday.

They use the chips from a local beef cattle herd that mostly eats grass, because the diet helps keep the chips dense and strong.

The hot, dry summer – which has caused crop, water level and other problems across the nation – caused the grass to brown and cattle to stay near their barn for food and to keep cool. That means the manure in the pasture wasn't able to dry and flatten in the sun.

The committee that runs the festival usually goes out once in July to shovel the manure and let it dry in wagons in the sun. But this year they had to skip it because of the poor quality.

Instead, a few organizers went out sporadically and collected about a third of the usual amount – 200 or 300. Every year they keep the good ones that don't break – so they will dip into the 150 to 200 in reserve barrels for this year's competition.

When searching for chips, they look for them be about the size of a ping pong paddle.

"If it looks like it has air bubbles on the top, it's bad chip," Reuter said. "It won't be worth it because it will be light and airy. But if it's thick and solid and grassy, it's a good chip."

Once they dry, they don't really stink anymore.

"A lot of people are afraid to pick it up," said Terry Slotty, who runs the throw every year. "They look at it, and it looks like what it is but once they touch it they notice that it's very dry."

The men's record was set in 1991 at 248 feet. The woman's record is from 2005 at 157.5 feet, Reuter said. The festival will give the top finishers $200 each toward a trip to the World Championship Cow Chip Throw in Beaver, Okla., should they decide to go, Slotty said.

Reuter's brother, Russ Ballweg, who is the festival's grounds chair, said they are already planning on a backup plan for next year.

"We are probably going to have to go out more often and pick so we can get our reserve back up a little bit," he said.

The drought has caused a shortage of flattened, dried cow manure – or cow chips – for the Wisconsin State Cow Chip Throw and Festival, which attracts about 300 throwers and 40,000 spectators to Prairie du Sac, Wis.

"This is my 24th throw, and it's never been this difficult to find chips," said Marietta Reuter, who helps organize the festival that runs Friday and Saturday.

They use the chips from a local beef cattle herd that mostly eats grass, because the diet helps keep the chips dense and strong.

The hot, dry summer – which has caused crop, water level and other problems across the nation – caused the grass to brown and cattle to stay near their barn for food and to keep cool. That means the manure in the pasture wasn't able to dry and flatten in the sun.

The committee that runs the festival usually goes out once in July to shovel the manure and let it dry in wagons in the sun. But this year they had to skip it because of the poor quality.

Instead, a few organizers went out sporadically and collected about a third of the usual amount – 200 or 300. Every year they keep the good ones that don't break – so they will dip into the 150 to 200 in reserve barrels for this year's competition.

When searching for chips, they look for them be about the size of a ping pong paddle.

"If it looks like it has air bubbles on the top, it's bad chip," Reuter said. "It won't be worth it because it will be light and airy. But if it's thick and solid and grassy, it's a good chip."

Once they dry, they don't really stink anymore.

"A lot of people are afraid to pick it up," said Terry Slotty, who runs the throw every year. "They look at it, and it looks like what it is but once they touch it they notice that it's very dry."

The men's record was set in 1991 at 248 feet. The woman's record is from 2005 at 157.5 feet, Reuter said. The festival will give the top finishers $200 each toward a trip to the World Championship Cow Chip Throw in Beaver, Okla., should they decide to go, Slotty said.

Reuter's brother, Russ Ballweg, who is the festival's grounds chair, said they are already planning on a backup plan for next year.

"We are probably going to have to go out more often and pick so we can get our reserve back up a little bit," he said.

The Dollar Will Collapse

The dollar and the U.S. bond market are headed for a collapse as the U.S. Federal Reserve loses the ability to service the nation’s debt with “artificially low” interest rates.

As far as I am concerned, U.S. Treasurys are junk bonds. And the only reason that the U.S. government can pay the interest on the debt, and I say ‘pay’ in quotes because we never pay our bills. We borrow the money so we pretend to pay, but the only reason we can do it is because the Fed has got interest rates so artificially low.”

The Fed has been keeping rates on benchmark 10-year Treasurys low by purchasing bonds via quantitative easing (QE), and this will ultimately be the U.S. economy’s undoing. Unfortunately, we are going to get more QE than Rocky movies, because the only thing keeping this phony economy going is this QE. And the minute you take it away, it’s going to collapse.

Fed officials warned that the U.S. could be heading for a “fiscal cliff” at the end of the year if mandated tax increases and spending cuts are implemented. On the same day, fund manager Bill Gross, who runs the world’s biggest bond fund, told CNBC that the U.S. will face a downgrade of its triple-A debt rating if it did not fix its fiscal situation.

"It’s not just $15 trillion in terms of current debt,” Gross said. “It’s probably three to four times that in terms of Medicare, Medicaid, of Social Security, in terms of the present value.”

“So unless the U.S. begins to make some inroads, and that’s called the structural deficit that the (Congressional Budget Office) and the (International Monetary Fund) basically identified as perhaps six to seven to eight percent, greater than any country other than Japan and the U.K. Until we address that structural deficit, then yes, we're headed to double-A territory,” he said.

Euro Pacific’s Schiff predicts weakness in the U.S. dollar, which will put pressure on commodity prices and fuel inflation. This will in turn force the Fed to raise interest rates, he added.

“The Fed will not do it; the Fed knows the only thing propping up our phony economy is zero percent interest rates and quantitative easing. And I think when the market figures this out, it’s going to put even more pressure on the dollar,” he said.

Schiff is a well-known bear who predicted in 2008 that the dollar will collapse amid hyperinflation. That did not happen, and the dollar strengthened against most major currencies by the end of 2009.

Andrew Economos, managing director and head of sovereign and institutional strategy at JPMorgan Asset Management, said what the Fed is trying to do is “buy time” by keeping credit cheap and encouraging banks to lend.

So far it's not working.

As far as I am concerned, U.S. Treasurys are junk bonds. And the only reason that the U.S. government can pay the interest on the debt, and I say ‘pay’ in quotes because we never pay our bills. We borrow the money so we pretend to pay, but the only reason we can do it is because the Fed has got interest rates so artificially low.”

The Fed has been keeping rates on benchmark 10-year Treasurys low by purchasing bonds via quantitative easing (QE), and this will ultimately be the U.S. economy’s undoing. Unfortunately, we are going to get more QE than Rocky movies, because the only thing keeping this phony economy going is this QE. And the minute you take it away, it’s going to collapse.

Fed officials warned that the U.S. could be heading for a “fiscal cliff” at the end of the year if mandated tax increases and spending cuts are implemented. On the same day, fund manager Bill Gross, who runs the world’s biggest bond fund, told CNBC that the U.S. will face a downgrade of its triple-A debt rating if it did not fix its fiscal situation.

"It’s not just $15 trillion in terms of current debt,” Gross said. “It’s probably three to four times that in terms of Medicare, Medicaid, of Social Security, in terms of the present value.”

“So unless the U.S. begins to make some inroads, and that’s called the structural deficit that the (Congressional Budget Office) and the (International Monetary Fund) basically identified as perhaps six to seven to eight percent, greater than any country other than Japan and the U.K. Until we address that structural deficit, then yes, we're headed to double-A territory,” he said.

Euro Pacific’s Schiff predicts weakness in the U.S. dollar, which will put pressure on commodity prices and fuel inflation. This will in turn force the Fed to raise interest rates, he added.

“The Fed will not do it; the Fed knows the only thing propping up our phony economy is zero percent interest rates and quantitative easing. And I think when the market figures this out, it’s going to put even more pressure on the dollar,” he said.

Schiff is a well-known bear who predicted in 2008 that the dollar will collapse amid hyperinflation. That did not happen, and the dollar strengthened against most major currencies by the end of 2009.

Andrew Economos, managing director and head of sovereign and institutional strategy at JPMorgan Asset Management, said what the Fed is trying to do is “buy time” by keeping credit cheap and encouraging banks to lend.

So far it's not working.

tags:

dollar decline,

economic crisis,

economy default,

federal deficit,

global default,

market collapse,

US debt

Location:

Washington, DC, USA

US Economy At Risk For 2013 Recession

The latest data of durable goods orders, released Friday by the Commerce Department showed an increase of 4.2% for July but excluding transportation goods the order declined by 04%.

In addition orders for capital goods fell 3.4% over the same month while the June figure was revised down to 2.7%.

The latest data are not only very weak but are a sign of the weakest economic recovery since WWII according to several US economists and analysts.

The decline in capital goods orders is a sign that US companies are hesitant to invest and expand their production capacity in light of global uncertainty.

China, Europe and Brazil, once thought as the economic drivers to set the tone of recovery after the end of the economic recession in the summer of 2009, are now struggling themselves to keep their growth at a steady pace.

We have seen large dips in economic growth in China to an annual rate of 8%, down from 11% during 2011, and continued fiscal and debt struggles in Europe which largely affect the US economic growth overall since both regions are crucial to the US production output and exports.

US exports to both regions have been stagnating since 2007 due to a slowing demand from Europe and China.

China in particular struggles with high inflationary pressures which lead the government to intervene through quantitative easing to ensure their economy does not overheat. That results in a net decline of production materials which in large part are imported from the US.

Europe on the other hand is still not out of the woodworks when it comes to curbing the budget shortfalls and the debt/GDP ratios of some members which puts extra pressure on Germany, France and The Netherlands to control their inflation for the benefit of euro stabilization.

The US economy continues to grow albeit at a very slow rate but should the durable goods orders continue to falter then the risk of a double-dip recession in 2013 is not unimaginable.

This scenario would result in the unemployment rate rising again to 9%, currently at 8.3%, when the expected budget cuts and tax increases take effect early 2013.

The Federal Reserve has yet to give a sign that it is willing to implement QE3 but given the latest data it is expected that the next FOMC (Federal Open Market Committee) may hint at a higher possibility of bond buy-back programs to curb long-term interest rates even further and to encourage business borrowing and spending to keep the US economy for retracting any further.

Written by Nick Doms © 2012, all rights reserved.

Tuesday, August 28, 2012

2013 Great Depression: America Heading For Economic Collapse

Fear continues to grow in America. Drought, soaring food prices, unemployment, big banks up to their same old greed-driven tricks, threat of war with Iran, and degrading loss of liberty through legistation such

as the Patriot Act, SOPA, and the NDAA all add to a comprehensively

negative outlook for the future. However, of the multitude of real and

perceived catasrophies that could inevitably fall upon the American

people, one primary fear outweighs all the others... that of an economic collapse.

Here is the list of Feared Catastrophies as measured in a survey by the Ecohealth Alliance, and their percentage of importance.

- Economic Collapse: 46%

- Natural Disaster: 46%

- Terrorist Attack: 44%

- Global Disease Outbreak: 33%

- Global War: 27%

- Nuclear Accident: 25%

- Global Warming: 22%

- Fuel Shortage: 15%

- Cyber War: 8%

- Famine: 8%

- Oil Spill: 6%

- Industrial Accident: 5%

Overwhelmingly, the people's trust in a secure economy, and the

leaders who administer economic policies, is failing. Nearly two-thirds

of those polled fear a complete economic collapse based on the news and

evidence provided to them in both the media, and financial experiences

such as unemployment, higher retail prices, and lifestyle changes such

as losing a home, or falling home values.

Besides polling, the raw economic data also suggests an economic

collapse as being of high probability in the near or medium term future.

Global banks.

which make up the primary central bank shareholders for governments in

the west, have all fallen in value, been downgraded by ratings agencies,

and have experienced liquidity problems that have forced them to the

brink of insolvency at one point or another in the past three years.

- BofA: -60.38%

- Citi: -44.76%

- Goldman Sachs: -46.41%

- JPMorgan: -23.03%

- Morgan Stanley: -45.24%

- RBS: -50%

- Barclays: -34.32%

- Lloyds: -63.02%

- UBS: -29.33%

- Deutsche Bank: -28,55%

- Crédit Agricole: -56.04%

- BNP Paribas: -37.67%

- Société Générale: -59.57%

Lastly, the American people have had the opportunity to see what an

economic collapse in nations can do to the people, and the policies of

governments in both Greece, and in several Middle Eastern countries in

2011. When the solvency of a government fails, and international

monetary agencies such as the ECB and IMF attempt to impose austerity

measures such as added taxation, or cuts in public safety nets,

businesses begin to fail in large numbers, and people grow the internal

fortitude to lash out at the system.

If you want to see what happens when a collapse happens and a depression begins, just look at what is happening in Greece....

- 100,000 businesses have been closed since the beginning of the crisis.

- About a third of the nation is now living in poverty.

- The unemployment rate for those under the age of 24 is 39%.

- The number of suicides has increased by 40% in the past year.

- Thefts and burglaries have doubled.

- Things have gotten so bad that hundreds of families in Greece are abandoning their children.

Little has changed in the economic outlook for the

United States in the past year, the growing fears of an economic

collapse remain very high in the minds and fears of many Americans. In

the past 10 years, millions of jobs, and hundreds of thousands of

businesses have failed, or move overseas, and governments on a local and

Federal level have borrowed themselves into insolvency. With more

people expected to fall outside of the safety nets of unemployment, and

the ability of their legislators to solve the economic problems hanging

over the country like a Damocles Sword, the remaining avenue for

Americans will be the streets, not the ballot box if their primary fear

of economic collapse does take place.

tags:

2013 great depression,

economic collapse,

food prices,

food shortage,

job market,

ndaa,

patriot act,

unemployment

Location:

Washington, DC, USA

Gov't Explains 750 Million Rounds of Ammunition

I'm sure you've read about the multiple agencies of the federal government have ordered and are stockpiling 750 million rounds of ammunition, especially hollow point bullets. Why? Well, the official explanation does nothing but raise more questions.

Our government states

that the hollow point bullets it has procured are "standard issue" and

that they are used to train security agents used by each of the various

federal agencies.

However, according to retired Maj. Gen. Jerry Curry, a decorated Army

war veteran, the Feds' explanation about the bullets fails to pass the

smell test.

Yeah, right. As every gun owner knows if they are serious about developing

and maintaining their shooting skills, the type of bullets used for

practice at the firing range are normally different from the ammunition

one would use when getting the firearm set to be used in the event of a

home invasion or other situations in which one's life is in mortal

danger.

Firing range bullets are much less expensive and are not designed for

the day to day use of the gun for maximum self protection. One uses the

more expensive variety, such as hollow point bullets, for real-life

danger.

Something is wrong. Most citizens are likely unaware that such ammo is not used for

practice and will accept the government's explanation at face value.

This is in all likelihood what the Feds are counting on.

it became clear that the our government has not been honest with the public concerning the current mass stockpiling of ammunition.

Hollow point bullets are so lethal that the Geneva Convention does not allow their use on the battle field in time of war. Hollow point bullets don’t just stop or hurt people, they penetrate the body, spread out, fragment and cause maximum damage to the body’s organs. Death often follows.

During the Iraq War the U.S. military

used 70 million rounds of ammunition per year. Compare that with the 750

million rounds of hollow point bullets that the Department of Homeland

Security (DHS) ordered in March. And then it further ordered another 750

million rounds of various types of ammunition, some of which can

penetrate walls.

This is enough ammunition to empty five rounds into the body of every living American citizen. Is this something we and the Congress should be concerned about? What’s the plan that requires so many dead Americans, even during times of civil unrest? Has Congress and the Administration vetted the plan in public.

I fear that Congress won’t take these ammunition purchases seriously until they are all led from Capitol Hill in handcuffs. Why buy all this ammunition unless you plan to use it. Unknown to Congress, Does DHS plan to declare war on some country? Shouldn’t Congress hold hearings on why the Administration is stockpiling this ammunition all across the nation? How will it be used; what are the Administration’s plans?

The other factor that is raising significant concerns about the ammo

purchases is that the U.S. military and various law enforcement agencies

at both the federal and local levels have enough fire power to

adequately respond to any emergency or threat. But DHS now has enough

ammo on its own to kill every single American citizen plus potential

invaders such as Syrians, Iranians, or Mexicans.

You have to ask yourself: Why? And for what purpose?

Special thanks to Anthony Martin. Please visit his ministry at Martin Christian Ministries.

2013 Great Depression: Gold, Guns, and Spam

Over the past quarter, there have been a number of industries that

have shown both profit and growth in this recessionary economy.

However, outside of the popular, and heavily traded companies in the

market such as Apple, the primary industries achieving record sales and

record equity prices are none other than the disaster preparedness items such as gold, guns, and spam.

On Aug. 23, Hormel beat analyst expectations for revenue, primarily through sales in their Spam product lines.

Hormel Foods Corp. said Thursday that it earned $111.2 million, or 41 cents per share, for the quarter. That's up 13 percent from $98.5 million, or 36 cents per share, during the same period a year earlier.

Revenue for the period ended July 29 increased 5 percent to $2.01 billion from $1.91 billion, led by sales of Spam. This was slightly higher than the $2 billion that Wall Street forecast.- Associated Press

Besides the food component of disaster preparedness investing, two

other items, these being gold and guns, are seeing massive purchases in

several different quarters of the economy. Since November of last year, and in particular after the shooting massacre in Colorado last month, gun sales across the country are proceeding at record levels. And in regards to gold acquisition, economic disaster fears around the world have driven up the price nearly $80 in the last ten days alone.

Gold and silver both reached their 200 day MA on Aug. 23 for the

first time in several months, as investors like George Soros and John

Paulson invest in the metal's paper traded ETF's. Additionally, the

amount of gold and silver being accumulated by central banks has

increased several times in recent months, as global fears of Euro destruction and war in the Middle East accelerates.

The mantra and cry of those in 'Prepper Nation'

has always been about the accumulation of gold, guns, and grub. In the

3rd quarter of 2012, these three items are proving themselves to be

high priorities in what consumers are purchasing, and market trading

volumes in gold, guns, and spam are also validating this growing belief

by consumers that disaster preparedness investing is becoming a reality.

Obama Counts On College Voters

As college students return to campus, President Barack Obama’s campaign will be there waiting for them.

Obama aides sees college campuses as fertile

ground for registering and recruiting some of the more than 15 million

young people who have become eligible to vote since the 2008 election.

As Republicans hold their party convention in Florida this week, the

president will make a personal appeal to college voters in three

university towns: Ames, Iowa; Fort Collins, Colo.; and Charlottesville,

Va.

Obama’s victory four years ago was propelled in

part by his overwhelming support among college-aged voters, and polls

show him leading Republican rival Mitt Romney with that group in this year’s race.

But the president faces an undeniable challenge as

he seeks to convince young people that he is the right steward for the

economy as they eye a shaky post-graduation job market.

Seeking to overcome that economic uncertainty,

Obama’s campus staffers and volunteers are touting the president’s

positions on social issues, like gay rights, that garner significant

support among young people. Obama has stressed his effort to freeze the

interest rates on new federal student loans, a pitch he personalizes by

reminding voters that he and the first lady were once buried under a

“mountain” of student loan debt after law school.

They also see a fresh opportunity to court students – and their parents – following Romney’s pick of Paul Ryan

as his running mate. Democrats say Ryan’s budget would cut funding for

Pell Grants, the federal need-based program for students, and Obama’s

campaign is running television advertisements in battleground states

trying to link Romney to that plan.

Campaigning last week at Capital University in

Ohio, Obama told students that Romney’s economic plan “makes one thing

clear: He does not think investing in your future is worth it. He

doesn’t think that’s a good investment. I do.”

Before departing on his two-day trip, Obama was to

deliver a statement on Tropical Storm Isaac from the White House.

Administration and campaign officials were monitoring the storm as it

barreled toward the Gulf Coast, but as of Tuesday morning, the president

still planned to proceed with his travels.

Obama was scheduled to speak Tuesday at Iowa State

University and Colorado State University. The University of Virginia

rejected his campaign’s request to hold an event on campus Wednesday,

saying it would cause the cancellation or disruption of classes on the

second day of the semester. The event was instead being held at an

off-campus pavilion in Charlottesville.

Romney’s campaign sees an opportunity to cut into

the president’s support among young people by pushing a three-pronged

economic argument focusing on the nation’s high unemployment rate, the

soaring cost of college and the national debt.

“These kids haven’t even entered the workforce and they already owe the government a bill for the debt Obama has rung up,” said Joshua Baca, the Romney campaign’s national coalitions director.

Obama campaign officials say the start of the new

school year is a particularly crucial time to ramp up college

registration and make sure those new voters get to the polls. In many of

the battleground states, about 50 percent of the college students

register to vote on campus after Labor Day, according to the campaign.

And even those who are already registered may need to change their

address or other personal details after moving to new dorms.

At the University of Dayton, Daniel Rajaiah

encourages his fellow Democrats to carry voter registration forms to

class, to parties and around campus in case they find someone who hasn’t

yet registered. Members of the College Democrats set up tables in the

middle of campus a few days a week to catch students walking to class or

to the cafeteria.

“Our game plan this fall is to hit voter

registration very hard,” said Rajaiah, who is president of the College

Democrats of Ohio.

Obama’s campaign said it registered 10,000 voters

on college campuses in Ohio last week and signed up 300 new volunteers

at colleges in Iowa.

Four years ago, Obama won two-thirds of the vote

among 18- to 29-year-olds, compared with just 32 percent for his

Republican opponent, Sen. John McCain, according to exit polls.

An Associated Press-GfK poll released last week

showed Obama again holding a broad advantage among younger voters, with

54 percent of registered voters under 35 saying they would vote for

Obama and 38 percent backing Romney.

Drought 2012: Harsh Reality of Higher Food Prices

Droughts tend to produce vast yield variations. This week's ProFramer crop tour reaffirmed this tendency and as UBS notes, conditions declined with the expectations of low yields compounded by the harsher reality of poor quality

- likely to be a major issue for corn feeders.

Interestingly, Soybeans

looked good from the road but up close (pod formation and beans/pod)

were well below normal; and UBS adds to forget the CME for the moment - the cash market is now the attention grabber as they expect it to lead this rally in Ags higher - especially the July 2013s, raising an interesting question of if (or when) the US will restrict exports? Especially with no let-up in the drought conditions.

Lower yields AND lower quality...

With Corn and Soybean conditions data just awful...

and its not getting better anytime soon...

New Orleans Prepares For Hurricane Isaac

Hurricane Isaac strengthened Tuesday afternoon as it swirled over the warm waters of the Gulf of Mexico, pointed toward the fragile lowlands of southern Louisiana and the ever-vulnerable city of New Orleans.

In a bulletin issued at 5 p.m. Eastern Time, the National Hurricane Center said Isaac, upgraded from a tropical storm to a Category 1 hurricane earlier in the day, was “getting better organized” as its maximum sustained winds increased to near 80 mph. It said that further “slight strengthening” is possible before Isaac makes its predicted landfall Tuesday evening.

Isaac, once an unorganized and fast-moving storm, has slowed considerably and was plodding northwest at 8 mph by late Tuesday afternoon. Once it hits the coast, such a slow speed would be a cause for concern, because storms that travel at a leisurely pace tend to linger over flood-prone neighborhoods and dump large amounts of rain.

Forecasters are predicting 7 to 14 inches of rain once Isaac reaches land. Total rainfall could reach 20 inches in some isolated areas.

Sizable storm surges and massive amounts of rain would present the toughest test yet for New Orleans’s rebuilt levees, which are designed to endure all but the most catastrophic storms. The storm is also likely to test the federal government’s ability to respond to a natural disaster in the region seven years after the Bush administration fumbled the task in the wake of Katrina.

In a bulletin issued at 5 p.m. Eastern Time, the National Hurricane Center said Isaac, upgraded from a tropical storm to a Category 1 hurricane earlier in the day, was “getting better organized” as its maximum sustained winds increased to near 80 mph. It said that further “slight strengthening” is possible before Isaac makes its predicted landfall Tuesday evening.

Isaac, once an unorganized and fast-moving storm, has slowed considerably and was plodding northwest at 8 mph by late Tuesday afternoon. Once it hits the coast, such a slow speed would be a cause for concern, because storms that travel at a leisurely pace tend to linger over flood-prone neighborhoods and dump large amounts of rain.

Forecasters are predicting 7 to 14 inches of rain once Isaac reaches land. Total rainfall could reach 20 inches in some isolated areas.

Sizable storm surges and massive amounts of rain would present the toughest test yet for New Orleans’s rebuilt levees, which are designed to endure all but the most catastrophic storms. The storm is also likely to test the federal government’s ability to respond to a natural disaster in the region seven years after the Bush administration fumbled the task in the wake of Katrina.

Location:

New Orleans, LA, USA

Friday, August 24, 2012

PSYOP Missions Target US Citizens

The website Infowars.com has unearthed the smoking gun, a copy of a United States military manual entitled FM 3-39.40 Internment and Resettlement Operations, which appears to offer Defense Department insiders instructions on dealing with the imprisonment of anyone considered an enemy to the American way of life and how to go about indoctrination them with an “appreciation of US policies and actions” through psychological warfare.

The PDF made available is dated February 2010 but has only now been leaked online. A copy of the document has been uploaded to the website PublicIntelligence.net for viewing, and additionally a version appears to be hosted on the US Military’s Doctrine and Training Publications page at armypubs.us.army.mil, although access to papers published there are unavailable to those without the Pentagon’s authorization, therefore making it impossible to verify the authenticity of the manual at this time. The military site that appears to host a copy has also implemented security measures on its servers that it cautions visitors are “not for your personal benefit or privacy.”

Further, the title page of the manual warns that the material contained in its 326 pages is be distributed to US Defense Department and its contractors only, and that must be “destroy[ed] by any method that will prevent disclosure of contents or construction of the document.”

“This manual addresses I/R [Internment and Resettlement] operations across the spectrum of conflict, specifically the doctrinal paradigm shift from traditional enemy prisoner of war (EPW) operations to the broader and more inclusive requirements of detainee operations,” the paper’s authors explain in the first paragraph of the documents preface. From there, it goes on to explain that the methods of psychological warfare and brainwashing of persons applies to “US military prisoners, and multiple categories of detainees (civilian internees [CIs], retained personnel [RP], and enemy combatants), while resettlement operations are focused on multiple categories of dislocated civilians (DCs).”

The manual continues by describing categories of personnel whom are certain guidelines of the manual apply. A detainee, for example, is any person captured by an armed force, but does not include personnel held for law enforcement purposes — except where the US is the occupying power. Civilian internees are described as anyone “interned during armed conflict, occupation, or other military operation for security reasons, for protection, or because he or she committed an offense against the detaining power.”

“An adaptive enemy will manipulate populations that are hostile to US intent by instigating mass civil disobedience, directing criminal activity, masking their operations in urban and other complex terrain, maintaining an indistinguishable presence through cultural anonymity and actively seeking the raditional sanctuary of protected areas as defined by the rules of land warfare,” reads the paper. “Commanders will use technology and conduct police intelligence operations to influence and control populations, evacuate detainees and, conclusively, transition rehabilitative and reconciliation operations to other functional agencies.”

Fifty-six pages into the manual, its authors explain the role of psychological operations officers regarding internment and resettlement, and explain that they will be responsible for developing methods designed “to pacify and acclimate detainees or DCs to accept U.S. I/R facility authority and regulations.” PSYOP officers, the manual adds, identify “malcontents, trained agitators, and political leaders within the facility who may try to organize resistance or create disturbances.” The manual also demands that the PSYOP officers overseeing the detainment camps identify “political activists” for indoctrination.

False Unemployment Numbers

The US Labor Department declared that the

unemployment rate has dropped to 8.2 percent. While economists applaud

the latest news, the reality is improvement comes only after 3 million

jobless Americans are unaccounted for.

While job creation exceeded expectations for January, those

experiencing long-term unemployment — those jobless for longer than six

months, that is — remains at a record high.

In a new report from

the Pew Charitable Trusts, it’s revealed that those suffering the

longest from the unemployment epidemic exceed any monthly statistic

dating back to the World War II. The Labor Department figures that

5.5 million would-be workers have been without employment for 27 weeks

or longer, accounting for around 42.9 percent of the total tally of

unemployed Americans.

The consulting firm Hamilton Place

Strategies based out of Washington estimates that as many as 3 million

additional unemployed workers have been without jobs for just as long

but are not taken into consideration by the US government. For those, the Department of Labor simply stops counting them.

The government has also identified around 2.8 million Americans “marginally

attached” to the job market in January. Per their own definition, that

accounts for those who want to work and have looked for working during

the last year but have not concentrated their efforts on the job hunt

during the last month.

They are also not accounted for in the Labor

Department’s unemployment figure.

Speaking before the

US House of Representatives Committee on the Budget, Federal Reserve

Chairman Ben Bernanke addressed the issue. He admitted that the US

economy “has been gradually recovering from the recent deep recession,” but called long-term unemployment figures still “particularly troubling.”

“More

than 40 percent of the unemployed have been jobless for more than six

months, roughly double the fraction during the economic expansion of the

previous decade,” explained Bernanke. “We still have a long way to go before the labor market can be said to be operating normally.”

The Unemployed Generation?

Young America is struggling to find work. After

getting out of college and college debt has officially surpassed credit

card debt in the US.

Young workers are on the bottom of the ladder, are less likely to be employed than at any time since World War II.

The government data details that 41

percent of Americans believe young adults of the nation have felt the

impact of the economy more than any other demographic.

On the

other hand 29 percent say middle-aged Americans have been hit the

hardest and 24 percent believe senior citizens 65 and older have felt

the worst of the effects.

Many blame the government data that illustrates record gaps in employment between young and older employees in the job market.

The

analysis also revealed that 69 percent of those surveyed think younger

adults are having a tougher time than the previous generation to pay for

higher education, find employment, purchase property or even save for

the future. But not all young Americans are struggling to make ends

meet.

One third of the 18 to 34 demographic rate their financial

status as exceptional, but for the rest employers have taken advantage

of these trying times by cutting wages for entry-level positions as opposed to reducing the pay of more skilled employees.

Interest Rate For The "Rest Of US": 400%

When your local friendly Too-Big-To-Fail bank needs a 'helping hand'

loan to get through pay-day or buy some extra S&P futures, it picks

up the shiny red phone and asks Ben for unlimited access to free money.

When the 'rest of us' need a little extra - to get through the next week

before our pay-check hits, we call this guy - who charges a 400% APR.

The Central Bank Discount Window - Priceless.

What is perhaps most notable that no matter how much the CNBC anchors

tried to corner this gentleman into admitting his vig is a little rich,

the bottom line is that his services are in demand, and by a customer

that has a far higher annual household income that we would have

expected... once again the 'middle-class' is hurting to maintain any

standard of living.

Thursday, August 23, 2012

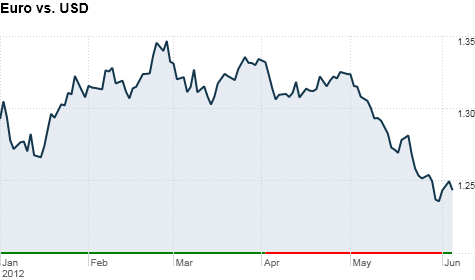

Hedge Fund's Record Bet Against Euro

Hedge funds are taking increasingly larger bets against the euro, as the debt crisis in Europe continues to heat up.

A record number of hedge funds made so-called short bets, or wagers that the euro would weaken, according to the latest report from the Commodities

Future Trading Commission that tallied the data for the week ended May 29.

Citigroup's foreign exchange analysts said hedge funds spent nearly $36 billion betting against the euro during that week. Only $11.8 billion went toward bets on a stronger euro.

The euro is down 7% from April, currently trading around $1.24.

The euro will most likely continue to trend lower, but most experts don't expect a free fall. "It will drip lower [but] there will be no overnight collapse," said Douglas Borthwick, head of trading at currency trading firm Faros Trading.

Hedge funds and other investors are capping their bets on the euro's decline because they could get burned if European leaders intervene, according to analysts and traders.

tags:

debt crisis,

europe,

financial collapse,

hedge funds,

short euro

Hedge Funds Betting On Collapse

Hedge funds are betting on a disaster hitting the financial markets within the next several quarters, with managers holding onto historic levels of cash.

That so-called dry powder gives them the cash they need to quickly jump in if markets sell off, according to numerous hedge fund managers and industry consultants.

”Most hedge funds I see are carrying lower market exposure than I’ve seen in some time,” said Brad Balter, founder of investment advisory firm Balter Capital Management. “This is not to say they are net short. They simply want to conserve their buying power and be ready for major opportunity sets that may arise.”Many are anticipating that Europe’s debt crisis, the U.S. fiscal cliff, or the slowdown in China will cause a 2008-like reaction around the globe, when stocks swiftly sold off in the wake of the financial crisis.

But betting on a downturn in this environment is a risky play.

The latest Fed minutes showed central bankers leaning toward more stimulus. Should Fed chairman Ben Bernanke suggest another round of bond buying next week in Jackson Hole, Wyo., stocks could swiftly move higher. On top of that, Greece is still in limbo and talk of the European Central Bank intervening in the bond market makes predictions about an end-game for Europe nearly impossible.

"I have not seen the level of uncertainty this high for a long long time," said Komal Sri-Kumar, chief global strategist at TCW . "If you were a hedge fund and you didn't know when the correction would come but were concerned, it would makes sense to keep cash available."

Because of this defensive posture, hedge funds have missed out on the 2012 stock rally. The S&P 500 (SPX) has gained 11% through July 31, while Morningstar's hedge fund index of nearly 1,000 funds gained just 3.7%.

"They could've picked stocks poorly, but with these returns, it looks more like they're not even close to being fully invested in the market," said Nadia Papagiannis, Morningstar's director of alternate fund research.

The SEC only requires hedge funds to disclose stocks they own, and not how much cash they're holding or what stocks they're betting against.

Holding onto cash is actually one of the boldest moves a hedge fund can make. Hedge fund managers get a 2% fee for all the money they manage, so investors quickly grow irritated with managers who sit and wait. "It's a natural reaction to say why am I paying you to hold cash," said Daniel Celeghin, partner at hedge fund consulting firm Casey, Quirk & Associates.

Some funds have outperformed the S&P. Among them: Tiger Global Management, which focused on technology stocks and counts Apple as its top holding, is up more than 20% as of July 31, according to a source with knowledge of the fund's returns. And the flagship hedge fund at Citadel run by billionaire Ken Griffin is up 11.5% through July 31, according to sources familiar with its returns.

Hedge funds betting on the mortgage market and those focused on financials have also scored big in 2012. Bay Pond Partners, owned by asset manager Wellington Partners, is up 11%, largely through its investments in bank stocks, said two sources. Two key funds at SPM, a $3.4 billion fund focused on residential mortgages, are up 13.4% and 11.3% respectively. Another mortgage focused hedge fund, Metacapital, is up 25% through July.

Despite the industry's overall recent poor performance, investors haven't shied away. In the first quarter of 2012, the hedge fund industry held a record $2.13 trillion of assets, according to Hedge Fund Research. During the second quarter, investors pulled back slightly, leaving them with $2.10 trillion.

Since the financial crisis, investors have been drawn to hedge funds because they have the ability to bet on all types of markets and don't simply expect stocks to move up. "The thought now is that I need to have at least some of my capital with managers who have the flexibility and skill set to take advantage of unpredictable sideways markets," said Casey, Quirk & Associates' Celeghin.

Mississippi River Traffic Moving Again

Barge traffic resumed along an 11-mile (17.7 kilometer) stretch of the drought-ravaged Mississippi River near Greenville, Mississippi, but dozens of vessels waited their turn on Thursday to pass in the shrunken waterway.

The Mississippi River, the country's primary highway for barge traffic, has dropped as much as 14 feet in the drought that has also withered crops in the Midwest and triggered wildfires in the West.

The latest incident occurred around dawn on Wednesday, just hours after the Coast Guard opened the channel near Greenville. Seventeen of the roughly 100 ships stuck since Monday made it through before one became lodged in the sand, forcing authorities to close the channel again for roughly 12 hours.

Traffic resumed late Wednesday afternoon with southbound vessels going through first, then northbound. After all those boats get through, the Coast Guard will continue directing river traffic on a staggered schedule, Gomez said.

As of Thursday morning, some 50 vessels remained backed up in the channel, waiting for their turn to pass.

Barge operators typically haul some $180 billion in goods annually, and the Mississippi River is their main artery with some 566 million tons (513.5 million tonnes) of freight going up and down the inland waterway each year, according to the American Waterways Operators, a national trade association representing tugboats, tow boats and barges.

The drought's effect on the river has caused logistical and financial woes for the barge industry.

Barges must unload 17 tons (15 tonnes) of cargo for every one-inch loss of water and 204 tons (185 tonnes) for every one-foot (30.5 centimeter) loss of draft, said Tom Allegretti, president of the trade association.

Draft is the vertical distance between the ship's waterline and the lowest point of its keel.

Allegretti said it would take 130 semi trucks or 570 rail cars to haul the freight unloaded by one large barge on the Mississippi River under those conditions.

OPERATORS LOSING MONEY

Barge operators are losing an estimated $10,000 per day for every one of their boats that sits idle near Greenville, said Ann McCulloch, spokeswoman for the American Waterways Operators said.

With 97 vessels idle on Monday and Tuesday, and 105 vessels idle on Wednesday, according to Gomez, that's nearly $3 million in lost revenues in three days.

"It's a day-to-day situation now to manage the stoppage," McCulloch said.

If water levels drop further, prices could rise on the raw commodities commonly shipped by boat, including coal, grain, petroleum and steel.

Taxpayers also share some of the drought's financial burden. The U.S. Army Corps of Engineers has dredged the river almost nonstop since the start of the drought with equipment costing as much as $85,000 per day, Corps spokesman Kavanaugh Breazeale said.

Dredging removes the silt that falls to the bottom of the river - a problem that accelerates as water levels drop. The Corps must keep the channels at least nine feet deep and 300 feet wide for safe passage of vessels.

Conditions were expected to improve in the short-term near Greenville, where the Coast Guard projects the river will rise about one foot by Monday.

But it forecasts a one foot decrease by Monday in Memphis, which has had its own headaches this summer. On August 9, the American Queen steamboat - a multilevel passenger vessel carrying some 300 pleasure passengers - got stuck near Memphis.

The river there could hit 10 feet below baseline by Wednesday, the Coast Guard said. That is nearing the historic low set in 1988 when river traffic came to a halt and an estimated $1 billion in revenue was lost.

Reuters - Colleen Jenkins, Greg McCune and Vicki Allen

tags:

barge,

closed,

disaster,

drought 2012,

economy,

food prices,

Mississippi,

mississippi river

Drought Worsens In Plains

While other corn growers already have knocked down their drought-ravaged crops to feed them to livestock, Nebraska farmer Doug Nelson still waits for his maize to mature, well aware it won’t be a banner year.

On the day a new report suggested the nation’s worst dry spell in at least a generation is deepening in America’s breadbasket, Nelson said Thursday he expects to harvest anywhere from nothing to 43 bushels per acre on his unirrigated acreage, a far cry from the 120 to 140 bushels he'd typically get. On the irrigated land, he could see 150 to 200 bushels an acre; in previous years, Nelson would see a minimum of 180 bushels.

‘‘For the most part, we haven’t seen a hit like this since 1974, as far as my career goes,’’ said the 61-year-old Nelson, who farms some 5,000 acres near Wayne. ‘‘But we'll have the combines going here in probably another month, and then we'll know for sure.

‘‘You can walk these fields and run into good spots, then walk another part where there’s a different soil and have nothing.’’

That’s part of the growing frustration with an increasing drought in Nebraska and several other farming states, despite recently cooler temperatures that have, at the very least, given people a break from this summer’s stifling heat.

The U.S. Drought Monitor’s weekly map showed that, as of Tuesday, just over two-thirds of Iowa, the nation’s biggest corn producer, was in extreme or exceptional drought — the worst two classifications. That’s up more than 5 percentage points, to 67.5 percent, from the previous week.

Nearly all of Nebraska, Kansas, Missouri and Illinois are in extreme or exceptional drought, with Illinois showing the most dramatic climb, spiking 17 percentage points in one week to 96.72 percent, according to the map.

In neighboring Indiana, where 5 inches of rain fell in some parts over the past week or so, the area in exceptional or extreme drought fell 9 percentage points, to 37.09 percent.

Conditions cooled in the region, but little or no meaningful rain fell, said Mike Brewer, a National Climatic Data Center scientist who put together the latest map, which is released by the National Drought Mitigation Center at the University of Nebraska in Lincoln.

The lack of rain allowed exceptional and extreme drought conditions to continue expanding in the area from northern Missouri and into Kansas and Nebraska, he said.

On Wednesday, the USDA added 33 counties from eight drought-stricken states to its list of natural disaster areas, bringing that tally to 1,821 counties in 35 states over the past six weeks. That’s more than half of all U.S. counties, and the vast majority received the designation because of drought.

Plains farmers have begun harvesting what corn managed to survive, although many growers cut their fields weeks ago, chalking the year up as a loss. Some ranchers have sold livestock because they had no grass for grazing or money to buy feed, the price of which has soared.

In the lower 48 states, there was a subtle increase in the overall area experiencing at least some drought, from 61.77 percent last week to 63.2 percent. There was little change in the overall area seeing exceptional or extreme drought, which went from 6.26 percent last week to 6.31 percent this week.

Rain is expected in the northern Plains in coming days, though it may be too late to save many withered crops.

The U.S. Agriculture Department twice has slashed its forecast for this year’s corn and soybean output because of the drought. In the spring, it forecast the nation’s biggest harvest, as farmers planted 96.4 million acres of corn — the most since 1937. But the agency now expects the nation to produce 10.8 billion bushels, the fewest since 2006.

If that estimate holds, the federal government says it will be enough to meet the world’s needs and ensure there are no shortages. But experts say food prices will almost certainly climb — corn is widely used in products ranging from cosmetics to cereal, colas to candy bars.

While just 1 percent of the nation’s corn crop is brought in from the fields by this time of year, the USDA said Monday in its weekly crop progress report that 4 percent of the harvest is complete. The reaping is farther along in Kansas, Missouri, South Dakota, Kentucky and Tennessee.

In an occupation that’s at nature’s mercy, ‘‘we've got to calculate we’re gonna lose a crop once in a while and calculate that into our expenses,’’ said Nelson, whose northeastern Nebraska farmland is about 60 percent corn, the rest soybeans. ‘‘Sometimes it’s heat, drought, excessive rains, bugs, winds. I guess that’s what keeps us coming back for next year.’’

© Copyright 2012 Globe Newspaper Company.

Subscribe to:

Posts (Atom)